Top Trending Stocks and Sector Snapshot for March 14

On a sideways range day in the US Equity Market, we may be less interested in “Top Trending Intraday Stocks.” Keep in mind we achieved initial targets I set forth in March 11th’s “Pullback Pathway Planning” for the S&P 500 (initial downside action also developed as highlighted in our Goldman Sachs (GS) Resistance Retracement Planning post).

Nevertheless, here are the top four uptrending and downtrending stocks at this particular snapshot in time from our scan.

Here’s today’s Uptrending Candidates to end the week:

The algorithm found Gap (GPS), Tyson Foods (TSN), Southern Energy (SO), and Northeast Utilities (NU) showing the strongest degree of intraday uptrend – and possible trend day continuity – mid-day.

If you’re looking for relative strength, take a look at strong Utilities stocks or the broader ETF symbol XLU.

Friday’s downtrenders:

The downtrending stock candidates include Tenet Healthcare (THC), Patterson Companies (PDCO), Cigna Corp (CI), and big name Apple Inc (AAPL).

Similarly, these can be used as potential candidates to trade additional pro-trend retracements (trend continuity strategy) or aggressive intraday potential reversals (possibly like Apple’s V-Spike price pattern).

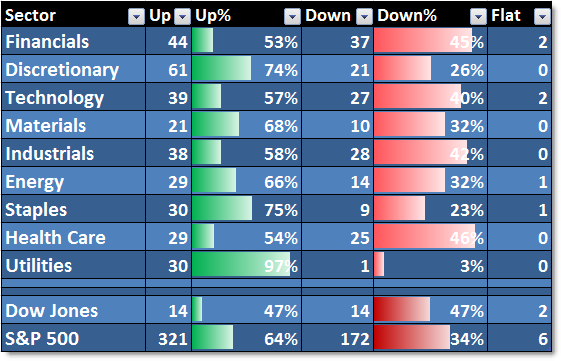

I’ll also start adding a S&P 500 Sector Performance (stocks in each sector) grid to reference the broader bullishness or bearishness of the session.

The custom grid below shows the number of S&P 500 stocks trading higher or lower by each main sector:

As always, you can review prior scans to see the outcomes:

March 12th Trend Day Stock Scan

March 10th Trend Day Stock Scan

March 7th Trend Day Stock Scan

March 6th Trend Day Stock Scan

March 5th Trend Day Stock Scan

March 4th Trend Day Stock Scan

March 3rd Trend Day Stock Scan

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

where do you get these scans Corey?

The new scan grid is a custom page in Excel I created from data pulled from TradeStation (RadarScreen) and the stock screen is from a custom formula/function also in TradeStation.

take a look at strong Utilities stocks or the broader ETF symbol XLU

http://www.mmocake.com/aion-ki…