Updated Post on IBM Shows Why Multiple Timeframe Analysis is Critical

In early July, I analyzed IBM’s daily and weekly structure because there were clearly conflicting signals depending on whether you examined the Weekly or Daily timeframe. Please reference the original post “Conflicting Signals in IBM” which was also published at the MoneyShow.com for the background before reading the resolution.

The main idea was that if you examined the Daily Chart in isolation, you would have seen a negative divergence along with a breakdown of moving average support and the likely expectation for a major trend reversal down to be the dominant trading idea – short.

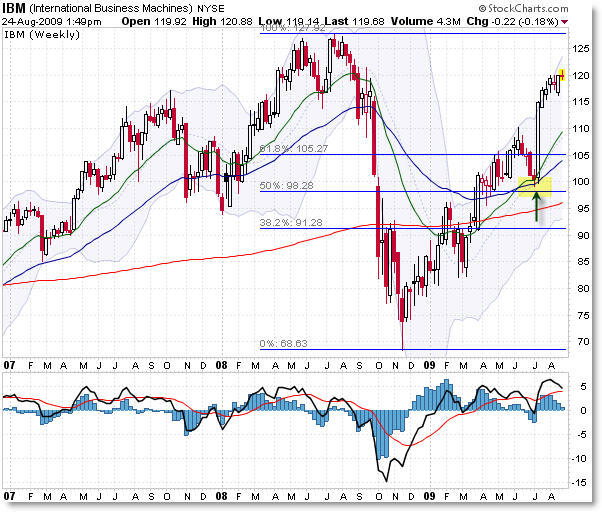

However, if you took a moment to look upwards at the weekly chart, you most likely were met with an opposing bias – that of the market rallying sharply and pulling back into a confluence support zone coming in from the intersection of the 20 and 50 week EMA along with the 50% Fibonacci price level – which gave an excellent low-risk buy opportunity – bias long.

So which viewpoint won? As you can see from the updated charts, I captured the prior charts – on July 7th – at the opportune time.

The higher timeframe weekly chart, suggesting confluence support, gave the complete picture as price did find support at the confluence level at the $100 price (which also served as “round number” or “psychological” support) and we had a very strong momentum move up that has taken price currently to the $120 level.

Let’s see this on the weekly chart:

There was also an ascending trendline (not shown) drawn off the November 2008 lows that served as another point of support at the $100 level.

There was the possibility that price would have formed a “Bear Flag,” but that pattern only would have triggered with a price break beneath the lower trendline should price have failed at the confluence support zone – this pattern did not complete or trigger an entry.

Instead, confluence support held via the 20 and 50 week EMAs, 50% Fibonacci retracement (just shy of $100), and the rising trendline.

The support was so strong and convincing, that a large momentum move rose off this level.

Now let’s take a look and see what happened to the Daily Chart, and all the traders who took a short-sale entry from the breakdown in price structure on that timeframe:

The section to highlight is the July 2009 period when price broke down beneath the rising 20 and 50 day EMAs after forming a momentum divergence into the $110 highs of June 2009.

A short-sale signal was triggered as price broke down with a stop-loss above $105, but it would have been a better idea to take a look at the Weekly Chart to make sure the higher timeframe supported this short-sale signal – as we saw above, it did not.

The proper short-sale would have been taken when price broke all the above support levels and triggered the “Bear Flag” pattern as mentioned above – it did none of these things on the weekly frame.

Instead, a person looking only at the weekly frame would have seen a low-risk, high reward buying opportunity with a stop beneath $100 (or as low as $95 to ensure safety).

The lesson learned is that we need to look at a higher timeframe to make sure the structure is favorable for our entry on a lower timeframe – particularly to check if the downward move on the Daily Chart was nothing more than a simple pullback retracement into confluence support on a Weekly Chart.

Using multiple timeframes – even just one higher timeframe – can add additional insights that would be missed by using singular timeframes.

Corey Rosenbloom, CMT

Afraid to Trade.com

Subscribe for the RSS Feed here.

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Good post. I wanted to mention: it is also important to know your timeline when entering a trade. As you can see on the daily chart, shorting IBM as it dropped below the MA's made a profit till the 5th day of the trade. If that was your targeted time frame you would walk away with a profit.

That being said, I completely agree with you about looking at the next larger time frame.

Good post. I wanted to mention: it is also important to know your timeline when entering a trade. As you can see on the daily chart, shorting IBM as it dropped below the MA's made a profit till the 5th day of the trade. If that was your targeted time frame you would walk away with a profit.

That being said, I completely agree with you about looking at the next larger time frame.

You’ll need no password to access the chaturbate token generator

– Neil – that is generated neither, which

we will all agree is a tedious process.