Weekly and Daily Conflicting Opportunites in IBM

We’re seeing a very similar situation in IBM’s Weekly and Daily charts that I highlighted in a prior post on RIMM (RIMM: Bullish or Bearish? Depends on Your Timeframe).

If you look in isolation at IBM’s Daily chart, you might want to get aggressively short right here right now thanks to a breakdown of support; however, if you look only at IBM’s weekly chart, you might want to get aggressively bullish thanks to confluence support. What does a trader do? Let’s take a look.

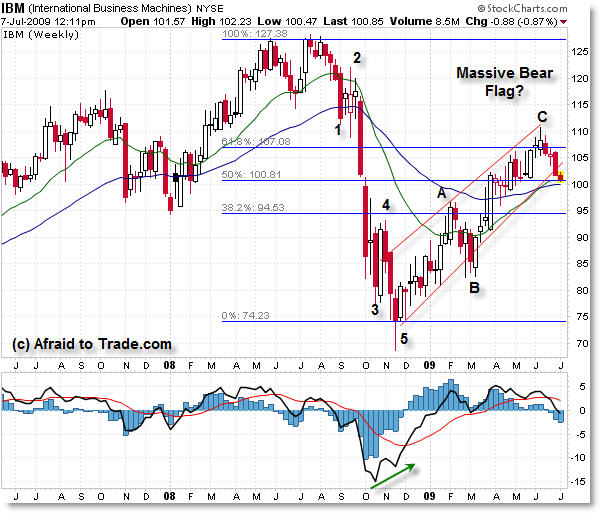

First, let’s start with IBM’s Weekly Chart:

I actually cheated and added extra analysis for you to give a little more insight.

The main idea (ignoring the Elliott notation for a moment) is that the $100 price level offers three levels of confluence support – first, from the convergence (and bullish crossover) of the 20 and 50 week EMAs.

Next, we see that a truncated Fibonacci grid from the 2008 highs (can you believe IBM peaked in mid-2008 instead of late 2007?) to the November closing lows yields the 50% retracement at $100.81.

Taken together, when a Fibonacci node intersects an EMA confluence, that yields powerful support.

Looking at these two facts, one might want to get aggressively long and place a stop conservatively around $98 or aggressively beneath $95.

With this bullish scenario in mind (again, ignoring the “bear flag” and Elliott Wave – we’ll come back to that), let’s look to see what the Daily chart reveals.

Next, to the Daily Chart of IBM:

Again, using basic technicals, we see a lengthy up-swing that may be ending. Price formed a ‘shooting star’ bearish reversal candle at $110 and has fallen to the $100 level, breaking down beneath the rising 20 and 50 day EMA, along with an up-sloping trendline connecting multiple lows.

There also was a negative momentum divergence that has peaked at the March momentum high – that’s a non-confirmation of higher prices.

Using this in isolation, a trader might get aggressively short and place a stop above $105 and play perhaps for a target of $84.

With simple technicals showing the weekly chart at confluence support, and also showing the daily chart breaking down from confluence support – what is a trader to do?!

Additional/Advanced Technicals

My main point in this post is to alert you that – in most cases – simple chart-reading will be effective. However, do not look at a single chart in isolation – always look at a higher (or sometimes lower) timeframe using those same ‘simple’ technicals to see what the picture really is and if you’re seeing a similar “story.”

In this case, you’re not, so if you’re a newer trader, it’s probably better to wait for a breakdown of confluence support on the Weekly Chart before getting short – after all, those confluence levels could hold as support as anticipated.

You can always move on to other stocks to trade that have clearer patterns to you.

As a bonus for more advanced readers, we see the Elliott Wave structure (possible count) hinting that a Wave C decline might be in the cards, as well as a potential to breakdown from a possible massive bear flag (link: basics of Flag Patterns). Traders unfamiliar with chart patterns or Elliott Wave (and no, you don’t have to know everything to trade successfully) would be unaware of these additional insights.

Stick with what you know, know your risk on a trade, and study multiple timeframes for structure.

Corey Rosenbloom, CMT

Afraid to Trade.com

Subscribe for the RSS Feed here.

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Excellent analysis

All the major markets seem on the verge of POTENTIAL major moves

The time of year, the lack of volume and the lack of volatility however are puzzling

Hmmmmm… Rather than an ABC wave I see a full up wave happening on the weekly chart. It is on the 4th (counter trend) wave and should have one more up wave. The daily looks pretty bad but I noticed a ton of congestion when it passed 100 the last time, that'll act as support. It also looks like a small ABC retracement. That being said, it broke below a trendline and the averages as you mentioned so it definitely isn't a long play.

Bo,

Good point – I was counting it as a Wave A down from the high; Wave B (which is a 3-wave structure) to present, and then perhaps Wave C down to form a zig-zag.

Daily has indeed taken some big damage.

I'm watching $100 very closely for a bounce but might get short if the broader market breaks down from the H&S as IBM would be breaking significant support as well.

Hey Reggie!

Right – it's not often we come into such significant nodes where we are now, but when the indexes come into a possible turning point, many internal (major) stocks like IBM will often show similar turning points.

I'm trying to find big leader stocks to get a leg-up on the possible next move in the S&P.

Excellent analysis

All the major markets seem on the verge of POTENTIAL major moves

The time of year, the lack of volume and the lack of volatility however are puzzling

Hmmmmm… Rather than an ABC wave I see a full up wave happening on the weekly chart. It is on the 4th (counter trend) wave and should have one more up wave. The daily looks pretty bad but I noticed a ton of congestion when it passed 100 the last time, that'll act as support. It also looks like a small ABC retracement. That being said, it broke below a trendline and the averages as you mentioned so it definitely isn't a long play.

Bo,

Good point – I was counting it as a Wave A down from the high; Wave B (which is a 3-wave structure) to present, and then perhaps Wave C down to form a zig-zag.

Daily has indeed taken some big damage.

I'm watching $100 very closely for a bounce but might get short if the broader market breaks down from the H&S as IBM would be breaking significant support as well.

Hey Reggie!

Right – it's not often we come into such significant nodes where we are now, but when the indexes come into a possible turning point, many internal (major) stocks like IBM will often show similar turning points.

I'm trying to find big leader stocks to get a leg-up on the possible next move in the S&P.