Ending Diagonal Leading Diagonal and Wedge Definitions SP500

I’m finding the “Diagonal, Wedge, Trend Channel, or Rounded Reversal” discussion to be interesting, and so I thought I’d take a moment to define what a Leading Diagonal and Ending Diagonal are as defined from A.J. Frost and Robert Prechter’s Elliott Wave Principle book.

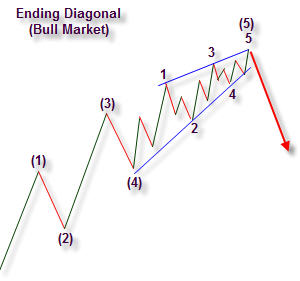

Let’s start first with an Ending Diagonal:

According to Robert Prechter (p. 37),

“An ending diagonal occurs primarily in the fifth wave position at times when the preceding move has gone ‘too far, too fast.” A Very small percentage of diagonals appear in the C-Wave position of A-B-C formations…. In all cases, they are found at the termination points of larger patterns. A contracting diagonal takes the wedge shape within two converging lines.”

“A rising ending diagonal is usually followed by a sharp decline retracing at least back to the level from which it began and typically much further.”

On the other hand, let’s look now at Prechter’s definition of a “Leading Diagonal:”

“It has recently come to light that a diagonal occasionally appears in the Wave 1 position of impulses and in the Wave A position of Zig-Zags. In the few examples we have, the subdivisions appear to be the same: 3-3-3-3-3, although in two cases, they can be labeled 5-3-5-3-5, so the jury is still out on a strict definition.”

“Analysts must be aware of this pattern to avoid mistaking it for a far more common development, a series of first and second waves. A Leading Diagonal in the Wave 1 position is typically followed by a deep retracement.”

Further, “[leading diagonals] were not originally discovered by Ralph N. Elliott but have appeared enough times and over a long enough period that the authors are convinced of their validity.”

In today’s pattern

As some readers have astutely indicated, what we have shaping up today is more of a “Leading Diagonal” instead of an “Ending Diagonal,” and have noted the subtle differences.

If we assume that March 6th was Primary Wave 3’s low, then we are now in Primary Wave 4, and have most likely just seen the majority of Wave A take place, and should be expecting a Wave B down which will be followed by a Wave C as I’ve drawn out in the above image.

As such, we need to eliminate “Ending Diagonal” as a consideration and look into whether this pattern is forming a “Leading Diagonal” under the definitions I have quoted from Mr. Prechter.

Either way, the implication is the same for the next likely swing – down – but the future predicted swings change after that… and also we are not in a bull market and can in no way count four waves of an impulse pattern, and thus cannot consider this ‘wedge’ formation an “Ending Diagonal.”

It’s also quite possible that we just experienced Wave 3 of the Leading Diagonal and not the final 5th wave – indeed it does seem there could be a slight bit of room for price to ‘play’ inside the trend channels.

Laying Elliott Wave aside, this all could just be a very simple bearish rising wedge – to chart this pattern, just take off the specific numbers from the diagram and note the converging trendlines.

Keep watching the S&P 500 price very closely for further clues as we get them.

Corey Rosenbloom

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Travel to the LA Trader’s Expo in June to hear Corey speak on “Idealized Trades for Intraday Traders”

This market continues to surge and the ROTATION that is going on is amazingly strong. The move up from today’s 1:55Pm low at 85.37 SPY has been impressive to say the least!!!

Looks like the April expiration push is alive and well . . . seems to have started on Wednesday as is quite typical in expiration weeks.

Mark,

I continue to be amazed at the audacity of the bulls. The Cradle Trade changed the structure to bullish, but bulls are shaking off everything.

Big day expected tomorrow – options & earnings.

Bob,

My thoughts exactly – options expiration happens before Friday now as patterns are being rolled forward in time it seems.

Oh, the ever-changing character of the market!

Corey,

Appreciate your concise analysis. I have been a bit EW fan for years. Your explanation is abit easier to understand. Under all of the scenarios, are you saying that a retrenchment is favoured by all 3 scenarios?

Sumo

Sumo,

While being aware that any bearish calls have been mercilessly twharted so far, that would be the implication, yes, once we got a break of these converging trendlines.

Of course, a break up outside of them would invalidate that view, unless the break turned out to be a more vicious bull trap.

A wedge, rounded reversal, or diagonal imply the next swing will be down… until proven otherwise.

Well Corey, as we discussed the other day, we just hit exactly on the nose a completed A=C move of precisely 203 pts at 870 today. (A wave from 741 to 944, B from 944 to 667, and C from 667 to 870).

Let’s see if this is indeed the end of a fourth wave irregular correction with wave 3 having ended in November at 741 or whether March 6 was the end of wave 3 as you suggest. Either way I’ll call an intermediate top (likely to watch it gap up at the open tomorrow).

I tried reading that book casually, however I quickly learned that it was a book that needed to be studied. Unfortunatelly I had to return it to my college whom I borrowed it from before getting a full dose. Will have to put that back on my req. reading list! Along with Dr. Steenbarger’s The Daily Trading Coach, and Trading in the Zone, have a lot of reading to do now that I think about it…

Keep up the great work Corey, certainly one the best trading blogs out there.

thanks for correcting that. btw I have your entire blog feed on my site, so if you feel you want to give in return, please add my link to your blog roll.

thanks

Im confused a touch , you say primary 4 but do you mean intermediate 4 ?

Thanks Corey for a another great post to solve the puzzle. Looks like we need more price information to come to any conclusions.

Would you recommend the “Elliott wave principle” book to improve understanding of EW.

I am under the impression that we have concluded a primary wave down, wave [1] and now are in wave [2]. It appears that we are nearing the completion of wave 1 of [2], rather than wave 4 of [1]. I believe this is the Elliott Wave Short-term Update’s position, although I am not a subscriber. Perhaps someone could shed some light on this for me.

I cannot believe intelligent people continue to use EW as a way to lose their money in the markets. As one who worked for the ‘premier’ exponent of EW, it only took me 17 years to realize it is useless.

Do yourself a favor, keep an honest track record of how many times you have to change your count to make sense of the market. It won’t take long to realize that every time you changed a count thinking you had it pegged, it only morphed into another situation where you have to change the count again. Meanwhile you are losing a lot of money do that. It doesnt work and is nothing more than mental gymnastics that will end up driving you crazy.

ABC,

Right – we should know soon (by next week perhaps) which pattern is dominant and playing out.

Ken,

Thanks for reading and for your comments!

You’re right – it took me a while to get through Prechter’s book – it’s definitely not Sunday afternoon reading at the beach. You almost have to take notes of all the principles and memorize them as best you can – and even then you still have to go back to the book and reference like I had to here. I was mistaken on my interpretation of an Ending vs Leading diagonal.

Dr. Brett’s book is one of those deep-thinking books, though Trading in the Zone (Douglas) is fun but power-packed with information.

Thanks, Ted!

I’ll check you out.

David,

No, at least I don’t think so. I believe we’re in Cycle C (from ABC of 2000-2009) and so I expect the 5 to be a 5-wave subdivision, so we would be in Primary 4 of Cycle C.

Another interpretation is that the March lows was Primary Wave 5 of C. That’s quite bullish, implying the correction is over.

I may indeed have that wrong but that’s how I’m interpreting it – other readers, feel free to share.

Anthony,

Thank you – yes, Prechter/Frost book is the next best thing to reading Ralph Elliott’s original work which would be much more expensive to collect and not contain modern charts/updates.

Glenn Neely has an excellent Elliott book out too that I’m reading now, but the Elliott Wave Principle is regarded as the modern day EW standard.

Rob,

I’m aware that is Prechter’s count (that we finished primary 1 and are in primary 2 and then primary 3, 4, and 5 are yet to come, taking us down to Dow Jones 400), but it is respectfully not a count I am willing to entertain in the slightest.

Anon,

I’ll allow your comment to add an alternate perspective but remember I am not here to be a defender/guardian of Elliott Wave, nor do I advocate using Elliott Wave in isolation. It is but one indicator/method among many.

Thanks Corey and appreciate your honesty and stance. My comments were directed toward those people who are new to playing the markets. Always maintain rigorous standards to weed out methods that are no better than hit or miss. Otherwise, it will be a very costly endeavor. Too many people see one count work and adopt EW as the Holy Grail only to regret it later.

FWIW, it works better as a tool to fade than rely upon. Most people currently label the recent high as just wave “a” of a larger a-b-c rebound. If the majority expects one scenario, the market will not accomodate them. You should be short now, with your stop above the recent highs.

hummmm…market is never wrong and has its own way to hunt for short selling like this we just have to make sure each set up ratio is 1-3 even some may caught for intra short or long to higher higher from the daily pattern after all false reversal always occur in wave label like this…. …be careful out there and NO Thrill for conscious…