Halloween Market Update and Stock Scan of the Day

Happy Halloween! The market spooked both the bulls with an end-of-day reversal (and close at the lows) but not before haunting the short-sellers (bears) with a new swing high. Very scary!

Let’s update our levels for the S&P 500 Index:

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

In the post-Fed rally, stocks again made a new swing high on weak volume, momentum, and internals.

Odds are shifting once again to favor another short-term pullback (retracement) away from the 2,090 level.

Focus on 2,090 – and then 2,100 if above it – and the current breakdown swing away from 2,085.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

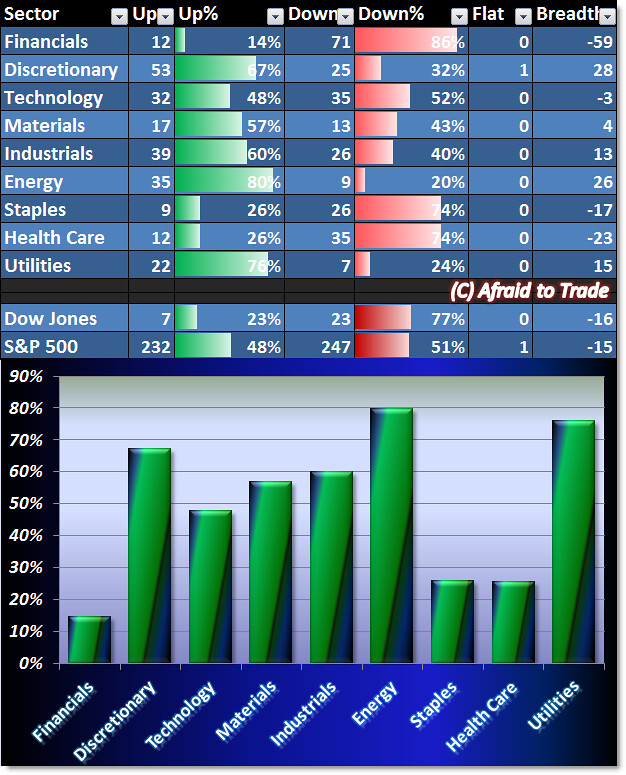

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

We had mixed information today as Financials were week while Utilities were strong – a bearish sign.

But wait – strength across the board concentrated in the Risk-On Offensive sectors – and NOT the defensive names like Staples and Health Care.

Caution is key when we’re not seeing clear direction in price, breadth, or sector rotational money flow.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Cooper (COO), Ctrip.com (CTRP), Bed Bath and Beyond (BBBY), and Fossil Group (FOSL)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Illumina (ILMN), Canadian Pacific Railway (CP), Apple Inc (AAPL), and GoPro (GPRO)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).