June 16 Range and Stock Scan Intraday Trading Update

We’re seeing another Range Day develop so far in the market.

Let’s update our intraday trading levels, scan breadth, and then pinpoint potential trend day trading stocks.

I’m highlighting the recent TICK (internals) and Momentum Divergences that preceded reversals of the intraday price trend.

The key to focus on now will be the dual negative divergence into the 50% “halfway” Fibonacci Retracement just above 1,940 which was today’s intraday spike high.

Price trades currently into the 38.2% Fibonacci Retracement, which will be our focal point at the moment:

A bullish “open air” impulse above 1,937 to 1,940 again or otherwise a bearish bias on any reversal down quickly from 1,937.

Sector Breadth tilts bearish today:

It’s not terrible, but 60% of Dow Jones stocks and 54% of S&P 500 stocks are negative right now.

The “Bearish Breadth” Signal comes from the relative strength of Energy, Consumer Staples, and the defensive Utilities sectors. Take note that 100% of S&P 500 Utilities stocks are positive on the session right now.

Our worst sector is the Financials where 13% of stocks are up right now (that alone is bearish).

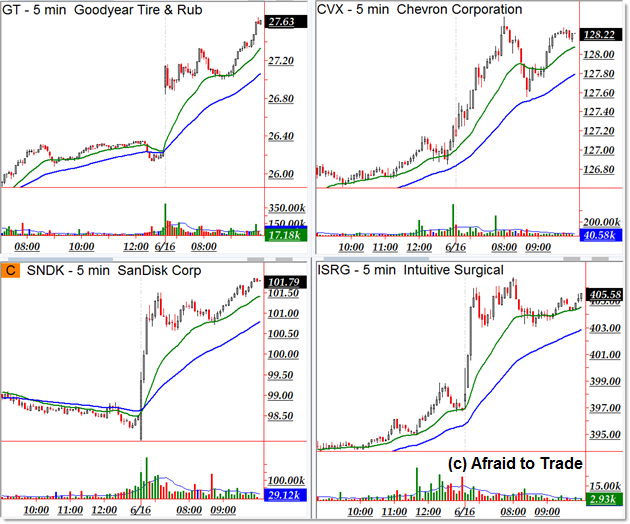

Still, we can turn our bull or bear intraday attention to possible trend day stocks on either side:

Bullish names include Goodyear Tire (GT), Chevron (CVX), SanDisk (SNDK), and Intuitive Surgical (ISRG).

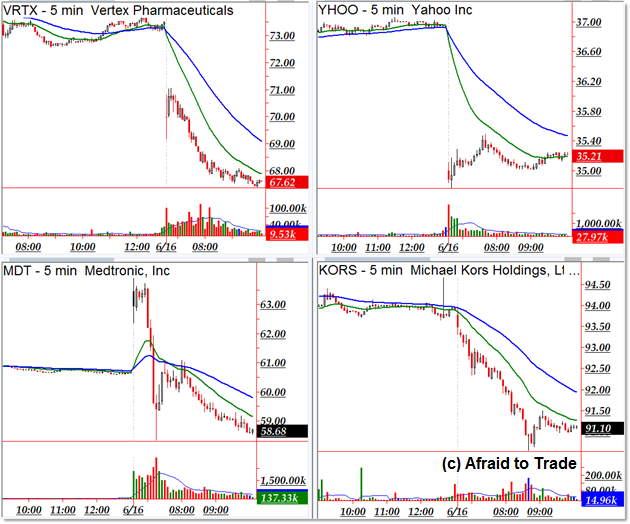

Bearish candidates include the following:

Vertex Pharma (VRTX), Yahoo (YHOO), Medtronic (MDT), and Michael Kors (KORS).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).