Link: Research on Weak Morning TICK and Close of Day

I wanted to share a timely link from Rob Hanna at Quantifiable Edges entitled:

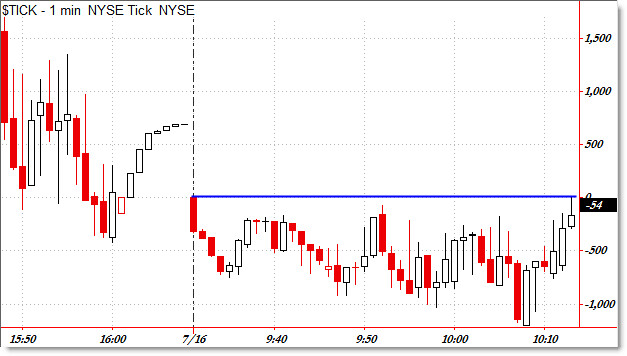

“What a Very Weak TICK has led to in the Past.”

I incorporate the TICK in almost every single intraday trade, but it’s nice to have quantified research to support your trading decisions.

The post is actually from February 2010, as Rob takes a look at what happens when the NYSE TICK remains under zero for the first 30 minutes and what is likely to happen in the close.

The link above references a strong negative TICK open, while the link below refererences a strong TICK open:

“What a Strong Early TICK has Meant in the Past.”

In both situations, Rob shows research where a strong opening TICK led in most cases to a continuation of that move into the close.

In other words, big TICK moves off the open are more likely to lead to price CONTINUATION in that direction, rather than reversal.

Thus, strong positive TICK concentrations more than not led to continued bullish moves into the close, while strong negative TICK concentrations off the open more than not led to further downside moves into the close.

Thanks as always to Rob for sharing his research!

Corey Rosenbloom, CMT

Hmm ok, am a trader wannabe, what do you think about Eternal Image, I read a news article that they have signed on a deal with a 140 year old company called Root Candles, please guide me, I wanna invest something xD

That is not what happened yesterday, but these are opex days and big news days.

Hey Terry,

No, yesterday did not quality because there were positive TICKs sustained in the first 30-min.

Rob is making the point that if the TICK stays sustained on one side of the zero line for the first 30-min, odds then favor a continuation of that direction into the close.

I have never heard of that company – and don't typically look at stocks from a news standpoint.

Oh, okay. But there is a momentum divergence all morning. We'll see how this plays out today Not trading because of opex, but would have made a nice trade short.

Understandable, as the risk is higher on OpEx days – as is the volume and volatility!

But what do we say about momentum on Trend Days? 🙂

Oh right!!! Why do I always forget that!! I'm going to pin that on my computer.

THANKS for reminding me, Corey!

Interesting that we haven't taken out the prior day TICK low as of 1:54

Agreed, but not surprising.

On such days, you often get an initial burst, sending almost all stocks to “tick” lower, but then the index creeps lower without climax moves that sends all stocks lower, thus resulting in a 'false' TICK divergence. Slow bleeds like this lead to false divergences that may or may not resolve into the close.