May 27 Rally Up Market Update and Big Stock Scan

Resiliently, buyers thrust the market higher off support to trigger ANOTHER Trend Day so far.

Be sure to reference yesterday’s post on the expected breakdown event.

Next, take a look at how we built successful reversal trades from the expected rally as seen in this morning’s update.

Let’s take a look at the current picture and plan the next step:

Here’s a key quote from yesterday’s mid-day report:

“At this point, the market has achieved a key downside target (2,100) on intraday positive divergences so we’ll be on guard for a bounce up off 2,100.”

From positive divergences at key support, an expected Phoenix Rose from the ashes of yesterday’s trend day.

Did yesterday’s session actually happen?

Given the fact that we’re right now just under yesterday’s opening price, it would seem the answer was no!

Nevertheless, traders had clear opportunities to trade short into the sell-off and then bullishly after the pivot-point divergent reversal.

Yes – the sell-off occurred as did the rally/reversal up off support – the market is doing EXACTLY what it should be doing.

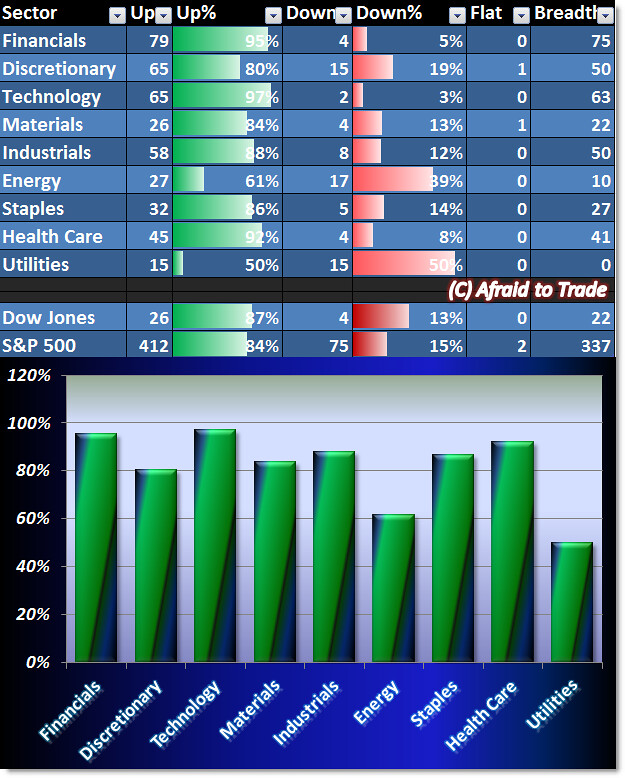

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Another “did yesterday really happen?” thought comes to us from Breadth where yesterday, virtually all stocks were negative on the session.

In today’s rally/reversal trend day, almost all stocks are positive today (roughly 85%).

We don’t see much difference in the strongest and weakest sectors, as all sectors (except Energy and Utilities) cluster near the 90% Breadth Levels.

Just as yesterday saw rapid risk-off pressure, today’ cross-checks that with eager “risk on” reversals.

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Hormel Foods (HRL), Tiffany (TIF), Lowe’s (LOW), and Spirit (SPR)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Michael Kors (KORS), Workday (WDAY), Kate Spade (KATE), and Valspar (VAL)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

One Comment

Comments are closed.