Nov 16 Bizarro World Market Update and Weird Stock Scan

With horrific terrorist attacks in Paris and beyond, and news of Japan officially slipping into recession, naturally stocks would be bullish and rise in a powerful trend day higher.

Of course they would! How logical! How simple! Get rich by doing the opposite of what you think should happen.

In our bizarro world, that’s exactly what happened and the chart strongly suggested this bullish outcome.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

We were bullish in Friday’s member report based on short-term positive divergences into a key support target.

I’m almost tempted to advocate that you listen to NO NEWS at all but focus exclusively on the charts but I understand how impossible that would be.

Nevertheless, stocks rebounded as if no bearish news at all existed over the weekend and built a strong trend day up off support (from divergences).

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

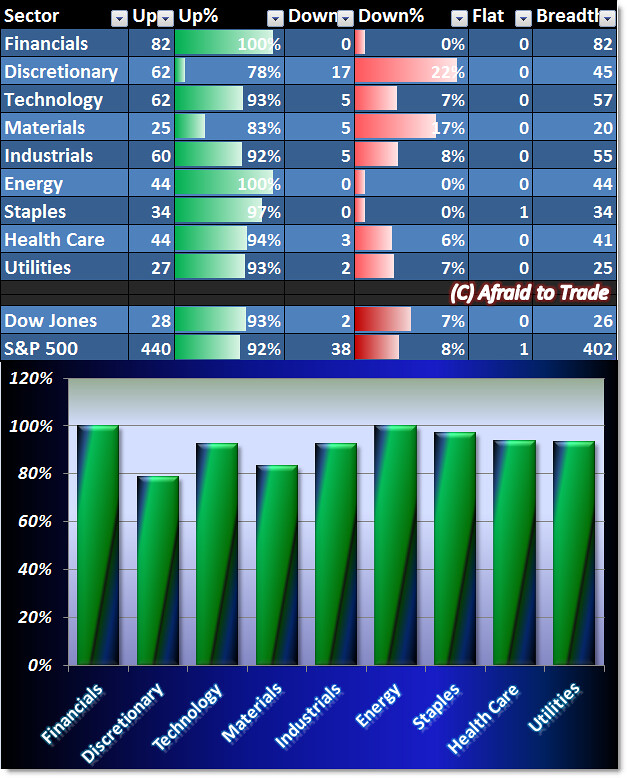

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Again, with nothing but bad news out there, naturally all sectors are positive and above the 80% Breadth Level (80% of stocks in the sector group are positive) today.

There’s no distinction between strong and weak with this type of money flow and thus we only trade with the tide (bullishly).

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

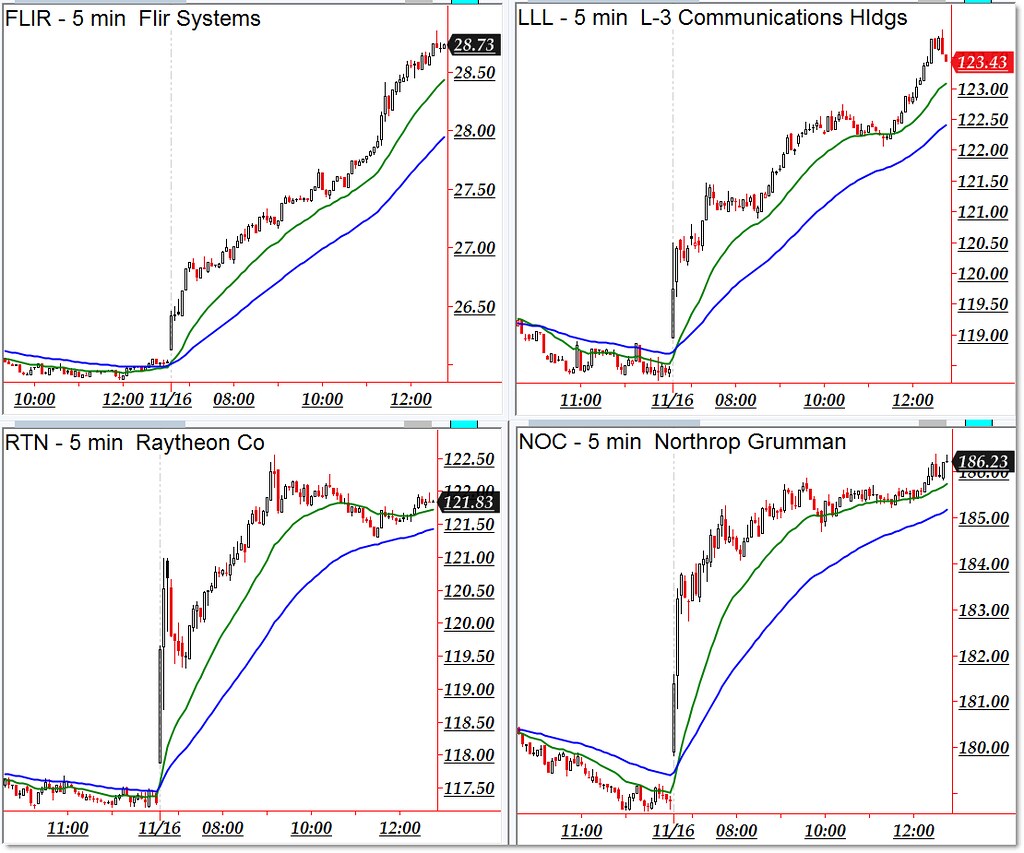

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Flir Systems (FLIR), L3 Com (LLL), Raytheon (RTN), and Northrop Grumman (NOC).

FINALLY there is logic in today’s session as defense stocks top the list of relative strength leadership.

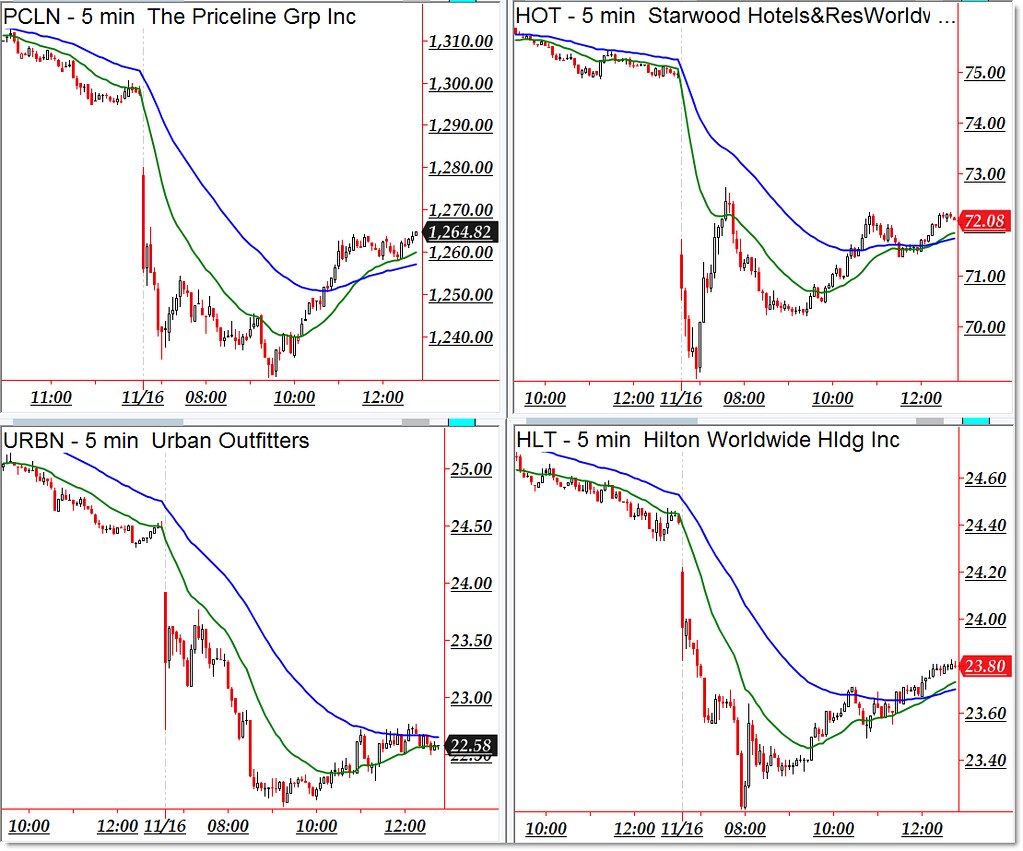

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Priceline (PCLN), Starwood Hotels (HOT), Urban Outfitters (URBN), and Hilton (HLT)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Good web site you have got here.. It’s difficult to find good quality

writing like yours nowadays. I seriously appreciate individuals like you!

Take care!! finance-courses.com

like best example!