Relative Strength and Weakness Stock Scan Candidates for Jan 7

For today’s “Post-Fed Minutes Update,” let’s focus on the top four Relative Strength leaders and laggards as possible trading candidates.

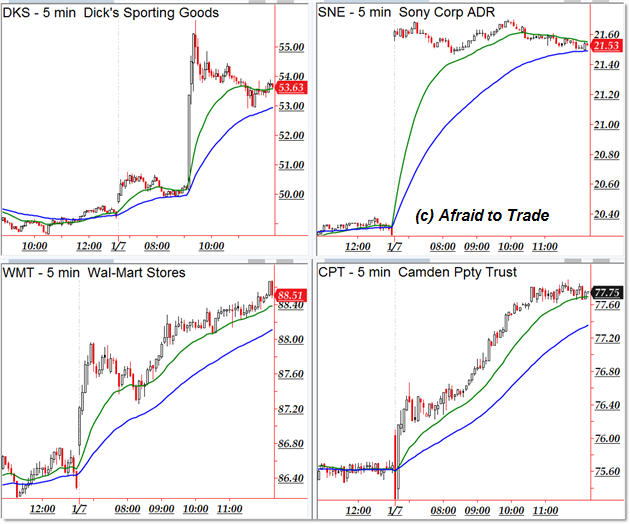

Without further delay, here are our top four strongest intraday trending stocks at the moment:

This list is similar to our Daily Update Posts using the relative strength algorithmic scan off the opening price.

Today’s bullish candidates include mid-day jumper Dick’s Sporting Goods (DKS), then Sony (SNE), Wal-Mart (WMT), and Camden Property Trust (CPT).

I wanted to take this post a step beyond what we see in the mid-day updates by highlighting the broader, possible swing trading opportunities in these stocks today.

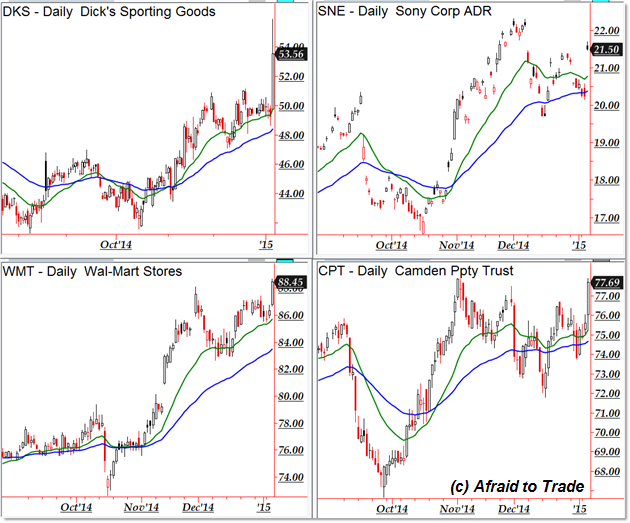

Here’s the higher frame Daily Chart of each of these candidates:

Dick’s Sporting Goods broke a key resistance level just above $50.00 per share to continue the bullish rally and thus demands our attention. Continue studying it on additional timeframes using your preferred indicators or trading signals (what’s strong often gets stronger).

Sony’s strength today doesn’t generate the same attention as Dick’s and Wal-Mart, both of which are pushing to new highs.

Finally, Camden Trust (CPT) simply returns to a possible breakout level. If you enjoy trading breakouts – and don’t mind non-flashy stocks – then watch for a break beyond $78.00 to trigger an entry.

We have the same logic on the sell-side and are prepared for possible market weakness:

21st Century Fox (FOXA), Sina Corp, Joy Global (JOY), and high-priced volatile Priceline (PCLN).

On the Daily Chart perspective, all stocks except 21st Century Fox are downtrending and breaking to new chart lows (PCLN isn’t quite there yet though).

That which is weak tends to get weaker – that’s why we identify trends and chart relative strength leadership (or weakness).

As always, study these watch-list (scan) candidates for current or near-term future trading opportunities (preferably in the direction of the established trend).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

We have to be good at understanding the strength and weakness not just of these stocks but also our own. I have understood what is my strength and that’s only with the help of my broker OctaFX, it has given me excellent 50% bonus on deposit that allowed me the freedom to test and try what suits me and because of that I have found where my strength lies in trading and I am able to succeed because of it.

We need to be very careful with these stuff since we all know how important stop loss and good money management here is, if we are not following that than we could lose badly. I trade with OctaFX broker and with them I get plenty of benefits given their rebate scheme which helps me earn 15 dollars profits per lot size trade and that is counting the losing trade too, so that’s why it is superb and helps me a lot.