Retracing Market Update and Stock Scan July 21

An actual retracement! Prices can actually fall! We’re all so surprised!

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

A lengthy rally with negative divergences set the stage for today’s pullback away from the 2,175 level.

Price fell all the way toward the 2,160 target before reversing up away from 2,160 on positive divergences.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

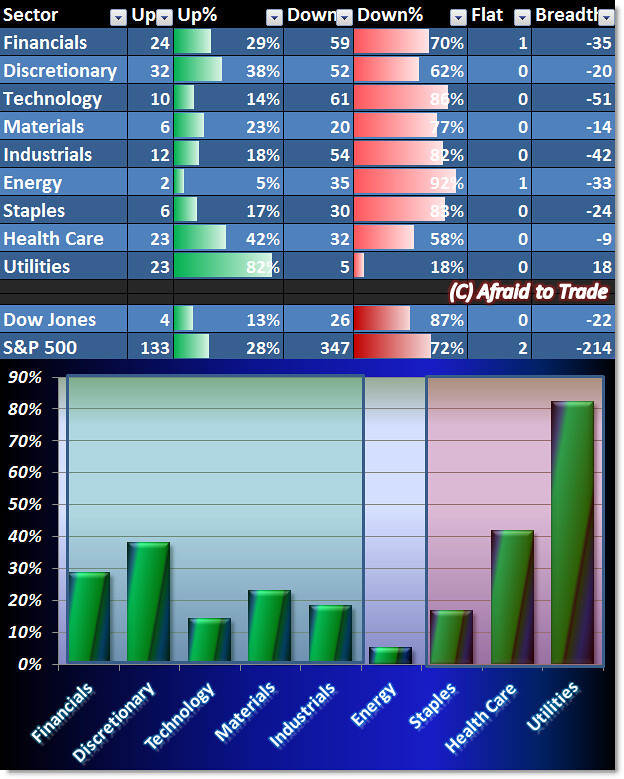

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Our Sector Strength (Money Flow) shows across the board weakness EXCEPT in the Defensive Groups.

Utilities and Health Care were the strongest sectors followed by Consumer Discretionary.

Energy is today’s weakest group.

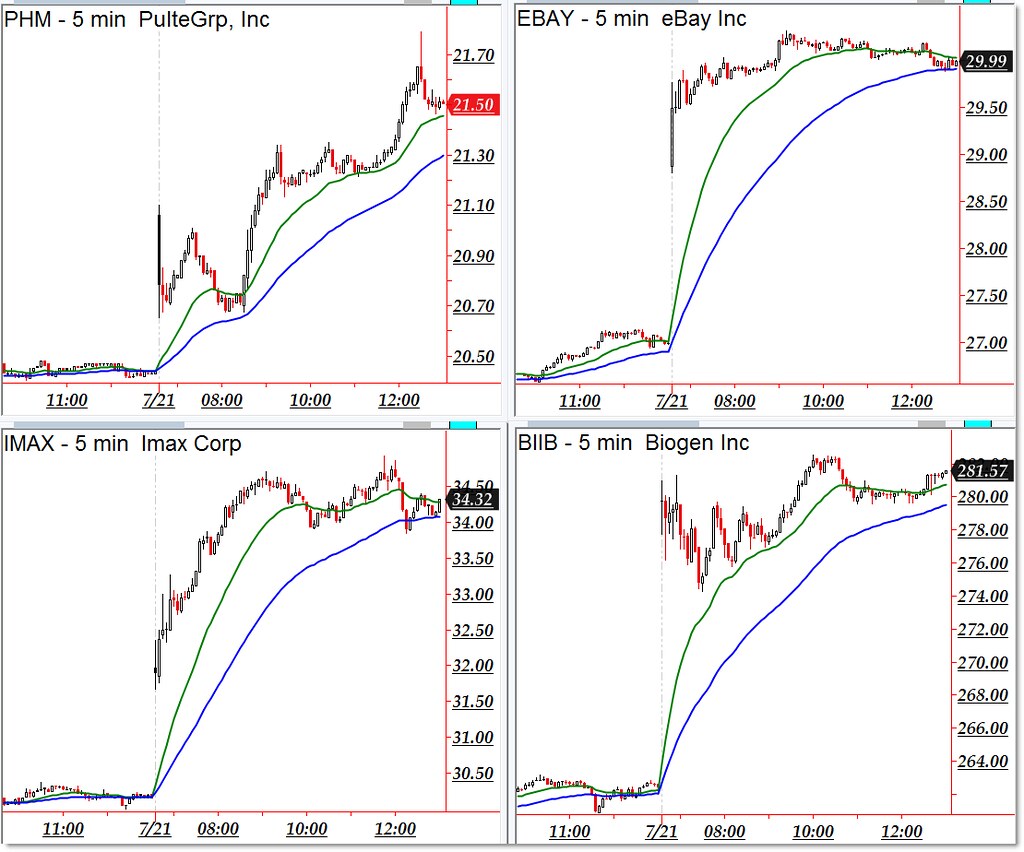

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Pulte Groups (PHM), eBay, IMAX Corp, and Biogen (BIIB)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Southwest Airlines (LUV), Sherwin-Williams (SHW), Raytheon (RTN), and Nike (NKE)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Got to be wise with this, as it can be good chance to make an appearance for short trade, but still got to cover all the plots given that is only way we will be able to achieve good results. I gain excellent support with OctaFX whether it’s with their swap free account that saves me from overnight charges or if it’s their daily market news and analysis service, it’s all very much reliable and easy to use for all with been free too.