Sharp Reversal Market Update and Stock Scan May 6

In the membership we were calling for a high-probability reversal away from the 2,045 level.

After one more dip beneath this level, we’re likely finally seeing the beginning of our intraday trend reversal.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

Multiple Positive Momentum and TICK (with Breadth) Divergences built up at the 2,045/2,040 index level, all of which suggested a likely reversal of the short-term (5-min intraday) downtrend.

Price surprised us with one more nip under 2,045 ahead of a strong intraday reversal – exactly as expected.

The S&P 500 index achieved its first upside target – the 38.2% swing retracement and prior high shy of 2,060.

We’ll focus on this level through the remainder of the session and into Monday.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

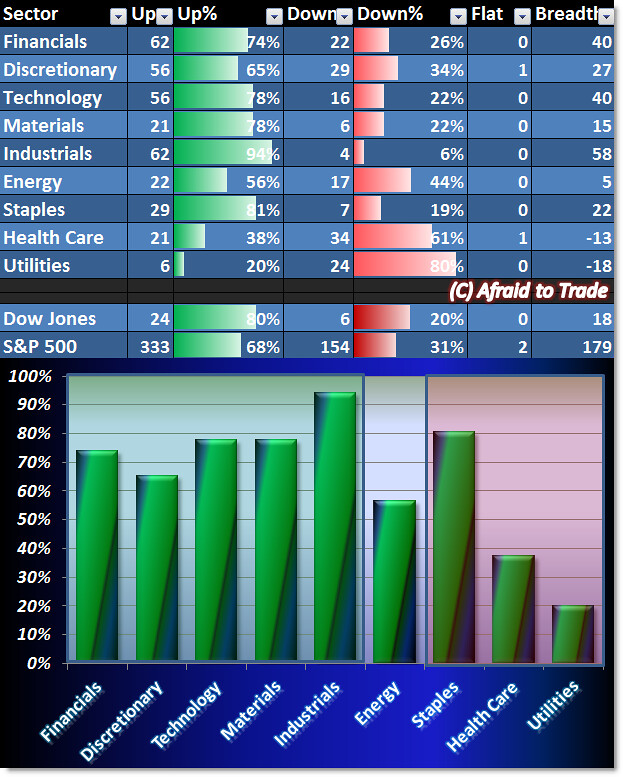

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

The Sector Strength Grid shows a bullish tilt because strength is concentrated in the Risk-On Groups.

Health Care and Utilities are today’s weakest sectors, showing a more offensive or Risk-On Money Flow.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

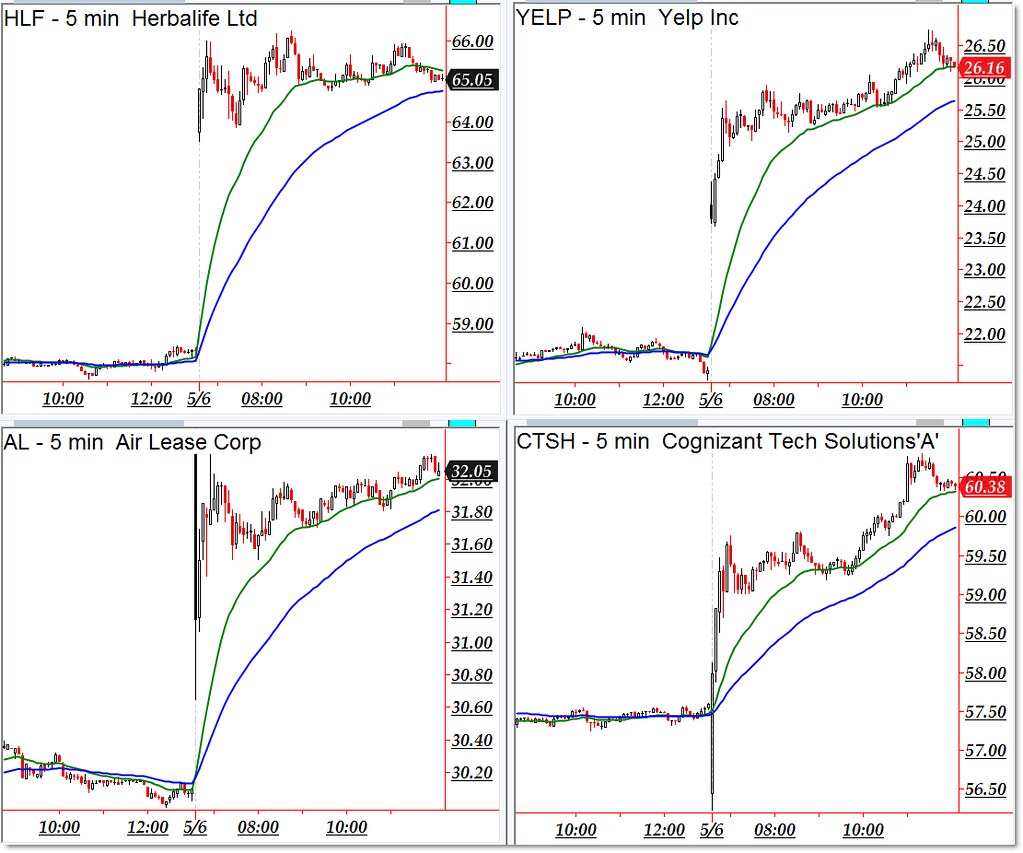

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Herbalife (HLF), YELP, Air Lease (AL), and Cognizant Tech (CTSH)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

SS&C Tech (SSNC), Teva Pharma (TEVA), Walgreen Boots Alliance (WBA), and Willis Towers (WLTW)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

There is always massive opportunity in reversal situation especially for day traders, I believe we can ride this in great way, but we obviously need to make sure we don’t do anything unnecessary and keep it simple. It’s also equal to use SL in such strategies or technique. I never worry about SL since with OctaFX broker, I get massive benefit which is with their cash back service that gives back 50%, so that keeps me secure with everything nicely.