The Weekly Autozone AZO AutoArc Reversal

Autozone (AZO) shares experienced serious selling pressure in 2017, collapsing from the $800 level toward the current break beneath $500 per share.

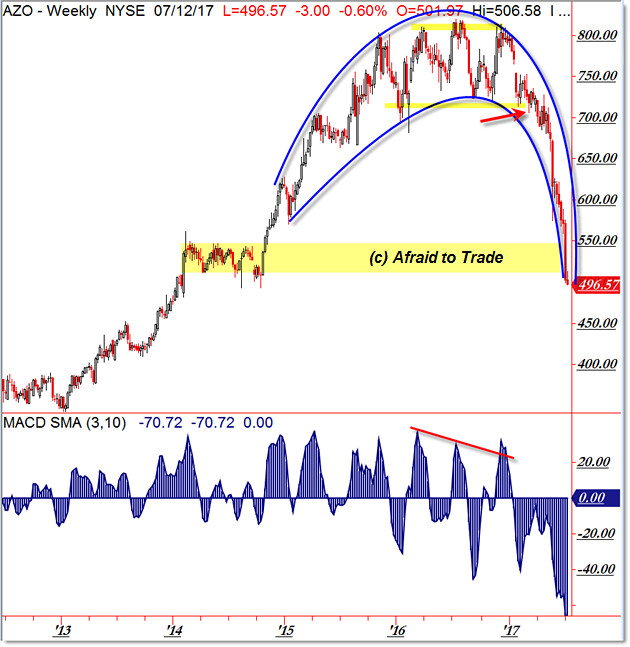

Let’s highlight the “Rounded Arc” Pattern – one of my favorites – and plot where we are now:

A lengthy bullish uptrend sent shares trending steadily higher above $800 per share.

However, negative divergences and the first lengthy sideways pattern gave rise to Distribution and a Rounded Arc (Rounded Reversal) Pattern formation.

A key support pivot developed near $725 per share and sellers finally plunged price beneath this pivot – and then beneath $700 – in early 2017.

Distribution and Price Mark-Down occurred faster than Realization and Mark-Up occurred over the prior years.

We’re reminded that “price takes the stairs up and the elevator down” from AZO shares.

Take a look at our recent post regarding a Similar Weekly “Arc Trendline Reversal” in GE.

At the moment, focus all of your attention on the current $500 per share “Round Number” reference level which also overlaps the low of the 2014 rectangle pattern (highlighted).

Failure to hold support (buyers fail to step in) here suggests even more Distribution and Mark-Down toward lower targets beneath $400 per share.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).”