Wednesdays with Wyckoff: Absorption and Distribution

This week’s “Wednesdays with Wyckoff” lesson gives us another colorful description of an important trading principle – that of supply and demand.

The lesson this week comes from Richard Wyckoff’s Studies in Tape Reading and explains how we can visualize supply and demand – absorption and distribution – in the context of a short-term move.

Let’s start with the text and then move to a present day example:

“Just now, I took a small piece of blotting paper [which is like a sponge to ink] and put it on the end of a pin. I then threw a blot of ink onto paper and put the blotter [sponge] into contact. The ink fairly quickly jumped up into the blotter, leaving the paper dry.”

“This is exactly how the market acts on the tape (price) when its absorptive powers are greater than the supply – large quantities are taken in at the offered prices and at the higher levels. The demand seems insatiable.”

“But after two or three ink blots had thus been absorbed, the blotter would take no more. It was thoroughly saturated. Its demands were satisfied.”

“Just in this way the market comes to a standstill at the top of a rise and hangs there. Supply and demand are equalized at the new price level.”

In this way, Wyckoff describes what happens when a blotter – or sponge with water in today’s terms (we don’t generally use ink blotters when writing) – absorbs the ink given to it when it is dry.

As the blotter (sponge) takes on more ink (water), there is a point of saturation where no more ink/water can be absorbed. This results in stability.

In terms of price, we can visualize a market at the end of a down move into support where a blotter/sponge appears (think “Buying Pressure”) to “soak up” or “absorb” the sell orders.

As the sell orders are absorbed by the market, price rises until the buyers are satisfied/satiated/finished buying and can thus buy no more.

Wyckoff then turns to describe what happens when supply (sell orders) overwhelm demand (buy orders) just as the blotter (or sponge) can hold no more liquid:

“Then I filled my pen with ink and let the fluid run onto the blotter (sponge). Beyond a certain point, the blotter would take no more. A drop then formed and fell onto the paper. The more I put on the blotter, the faster the drops fell.”

“This is a simple way of fixing in our mind’s eye the principle of opposing forces that are constantly operating in the market: Absorption and Distribution; Demand and Supply; Support and Pressure (Resistance).

When the liquid overwhelms the capacity of the sponge to take in (absorb) the liquid, the result is a ‘distribution’ of liquid from the saturated sponge.

Similarly, when supply overcomes demand in the market – ‘saturated’ – then price will fall until another dry sponge (buyers) steps in to absorb the selling pressure.

Alternately, one could say that the wet sponge “rung out” the liquid and thus dried as water poured out of it and was thus able to absorb sellers at a lower – dryer – level.

I guess in that sense, one could say that higher prices soak the sponge while lower prices dry it out.

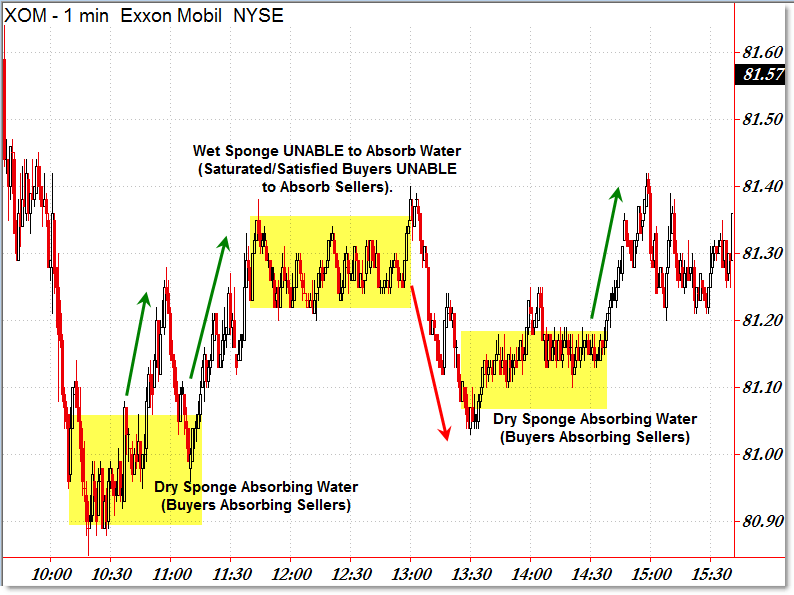

Anyway – let’s take a look at an example from today – XOM 1-min chart:

For simplicity, I’m using the concept of “Sponge and Water” as opposed to Wyckoff’s “Ink and Blotter” but the idea is the same.

A dry sponge is able to absorb sell orders, which drives price higher.

However, as the sponge (buyers) saturates, it can absorb no more sell orders. Instead, the added liquid (sell orders) into a fully saturated sponge results in liquid dripping down from the sponge, or in the case of the market, a distribution occurs which leads to lower prices.

As the liquid is “rung out” of the sponge, it becomes dry again and can thus absorb the sell orders. Or perhaps a new, dry sponge arises (more buyers) to absorb the sell orders at lower levels.

In XOM (any example will do), we see the cycle of dry to wet to dry sponge as price absorbs a morning decline, saturates at the $81.30 level, declines back to $81.00, and then absorbs the sellers with a rally back to $81.40.

Remember, a lot of Wyckoff’s teaching involve price and volume and how supply and demand interact to create trading opportunities.

To recap what we’ve learned so far, take a moment to read an earlier “Wednesdays with Wyckoff” update:

“Life Cycle Stages of a Stock Move”

“How I Select a Stock for Investing”

“Trading a Stock Breaking Through Resistance”

“Trading in Dull Markets and Breakouts”

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available!

What a information of un-ambiguity and preserveness of valuable know-how about unexpected emotions.