February 21 Top Intraday Trend Day Trading Stock Scan

What did our intraday scan reveal as the top “Trenders” so far mid-day February 21st? And will these stocks continue to develop a Trend Day structure into the close?

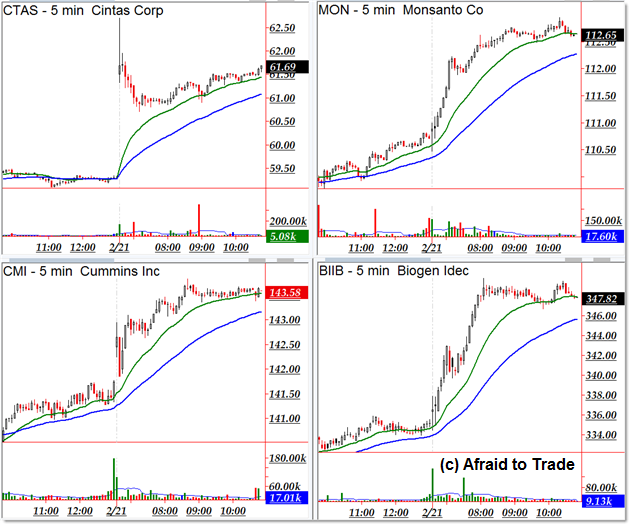

Let’s take a look at our “Top Uptrenders” of the Day so far:

Cummins (CMI) returns to the “Top Trender” list – it first appeared on the February 13th list.

Cummins is joined by Cintas (CTAS), Monsanto (MON), and Biogen (BIIB) for the top trenders and potential “retracement/trend continuity” candidates.

Not to be left out, aggressive traders can use these names to play a possible breakdown or intraday trend reversal should that develop.

Top Intraday Downtrenders for Friday February 21st:

The four “Top Downtrending” or “Sell-Off” Stocks include Costco (COST), Cabot Oil and Gas (COG), National Oilwell Varco (NOV), and Micron Tech (MU).

Notice the multi-bar sell-off I captured on the chart in Micron (MU) as I was publishing the scan.

Not all stocks on this type of scan list will continue for a pure Trend Day, but those that do can provide quick profits for those using pro-trend strategies such as trading breakouts and retracements on a classic Trend Day.

As I always mention, be sure to monitor price relative to the 5-min 20 EMA (green) and of course the orientation of the 20 and 50 EMA (spacing between them).

Speaking of Moving Averages, Club EWI is offering a free 10-page lesson on Trading with Moving Averages (I’m an affiliate).

As always, see prior scan posts to see the outcome (and for additional information):

And the original February 10 Intraday Trenders

Also, the compilation post “21 Examples of Trend Days”

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

3 Comments

Comments are closed.