Jan 14 Selling Market Update and Trending Stock Scan

We have yet another sell session in motion, let’s take a moment to highlight key levels, read breadth, and find opportunities in the top trending stocks for the day.

We’ll start as usual with our S&P 500 level chart:

Ultimately, price is doing exactly what it should be doing, at least in terms of breaking out of the compression (see my prior update on “Support and Resistance Planning for the S&P 500 and Dow Jones“) and trading down toward the 2,000 target.

The focal point today certainly shifts to 2,000 and the “Hold or Break” (so far it’s breaking) outcome there.

Look to play bearishly on a movement down away from 2,000 toward the prior low near 1,980.

Otherwise, we’ll plan for bullish “bear trap” or bullish plays on an intervention that takes us back above 2,000.

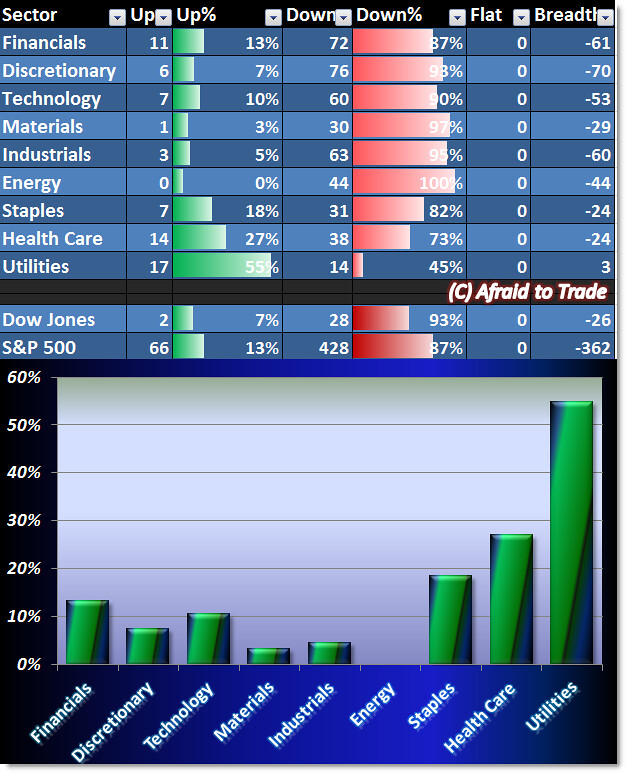

What is Sector Breadth revealing about today’s session? Let’s discover together:

As would be expected, Sector Breadth is bearish with the strongest sectors in the Defensive Group.

Utilities tops the day with a 55% positive rating along with Health Care and Staples – confirming the bearish selling pressure or defensive market posture today.

We have potential bullish trend continuation plays in the following stocks:

Intrexon (XON), Monster Beverage (MNST), Diamondback Energy (FANG), and Omega Healthcare (OHI).

Potential downtrending candidates exist in stocks showing relative weakness today:

Allegheny (ATI), M&T Bank (MTB), BHP Billiton (BHP), and JP Morgan Chase Bank (JPM).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

In a business like Forex trading the best policy is just to follow the trend as not even in our worst nightmares we want to get against the trend. It’s really deadly for the capital, hence trade only with the trend and still use tight money management. I am able to work really well with OctaFX company as they have amazing rebate service system where all of us can earn up to 15 USD per lot size trade no matter if trade is won or lost.