Updating SP500 Market Structure for January 2012

The S&P 500 is compressing between a shorter-term and broader consolidation pattern, so it could make for an interesting breakout resolution yet to come.

Let’s take a look at the bigger picture of Market Structure and then zoom-in on the intraday structure to note key reference levels.

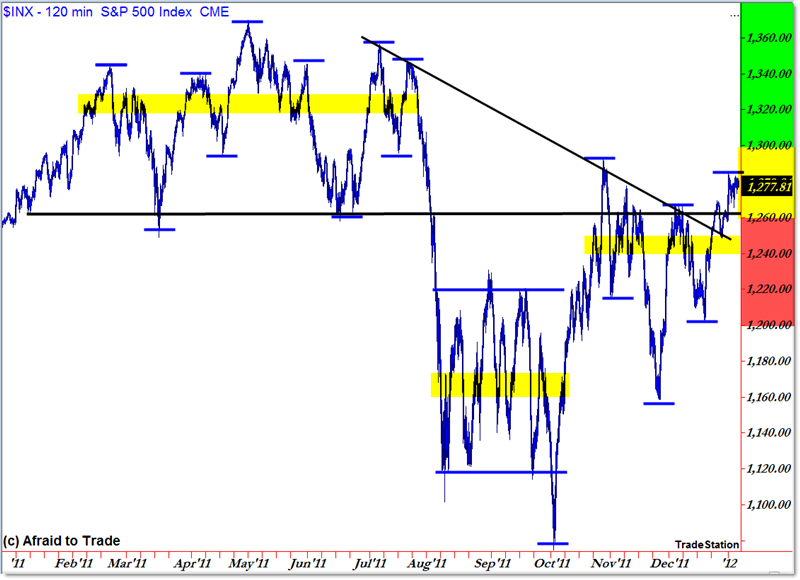

First, the broader picture starting with 2011:

To recap, when we say “Market Structure,” we’re referring to the progression or sequence of price highs and lows.

In simplest terms, a series of higher highs and higher lows comprises an uptrend – vice versa for a downtrend – and a series of compressing highs and lows indicates a sideways consolidation structure.

Unfortunately, 2011 was more of a broader consolidation or sideways trend structure than anything else, which makes it very difficult to trade. Traders often do best in trending environments.

Anyway, I highlighted “Value Areas” or Midpoints of known consolidation periods – Rectangles – in the context of the bigger picture.

We see three distinct “Value Areas” to watch:

- 1,330 is the upper range for most of 2011;

- 1,165 is the lower range from August to October 2011;

- 1,250 is the current short-term Value Area from November to present.

Beyond the Value Areas, we have the Price Structure itself which shows the Swing Highs and Lows themselves.

The other thing to watch is the falling Trendline (black) that connects the recent swing highs as labeled.

Price currently rests ABOVE the trendline as well as the long-term horizontal pivot point at 1,260.

In simplest terms – we need to reference price relative to 1,260.

The immediate levels to watch are 1,300 (upper resistance) and 1,260 (lower confluence support).

These would be levels to watch for any sort of breakout which could extend into a continuation/breakout move, target 1,375 if firmly above 1,300 or else 1,200 again if under 1,260.

That’s not much help at this exact moment, as price relaxes in the “Will it or Won’t it Breakout” zone between these two levels.

Let’s zoom in to the hourly structure for a tighter perspective:

I mentioned the broader compression pattern, and we’re seeing a similar visual trendline and price-swing compression developing in an even narrower range which just underscores the indecision – and tension – building in the market at the moment.

Price tends to eject powerfully from compression patterns, which was the case in the short-term Triangle compression in November (highlighted above with the “Break” arrow).

Here’s what we can conclude in terms of supply/demand at the moment:

- Sellers are dominant near 1,280, rejecting price and forcing reversals there to create a resistance barrier;

- Buyers are dominant at increasingly higher levels, forcing reversals off 1,100, 1,160, and recently 1,210.

You could call this a type of Ascending Triangle and use that logic to plan strategies from there.

Current Short-Term Value exists near 1,250 – it’s the spot where we can draw the most price-bar overlap and it was the Midpoint of the November Triangle pattern.

Hang in there – don’t get frustrated in this tightly compressed price environment.

Keep these levels objectively in focus as you trade the intraday or swing opportunities that you find.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available!

Baa©

That's really a excellent feedback on bigger picture of Market Structure showing with a update definition.I like this nice collection.

NIFTY COUNT PLEASE ITS BEEN AGES

youtu.be:VojhqH_zFC0.webloc