Yet Another Selloff Market Update and Big Trender Stock Scan Sept 4

A sideways Triangle Pattern is forming in the market right now in a consolidation from the collapse.

We have new levels – and new targets – in play.

Let’s chart the levels and possible outcomes here:

We provide in-depth analysis and planning to members of the Premium Daily Reports – I hope you’ll join and benefit.

I discussed – and charted – this sideways triangle pattern for members last night.

At the moment, we find ourselves down at the lower support level and actually threatening another bearish breakdown.

If price holds under the 1,910 level and then goes on to break under 1,900, it could lead to another play toward 1,860.

However, we’ll be cautious and look for a bullish bounce through the green zone IF we see a sudden reversal.

Receive daily updates, planning, and education by joining fellow members of the Afraid to Trade Premium Membership (before subscription prices rise).

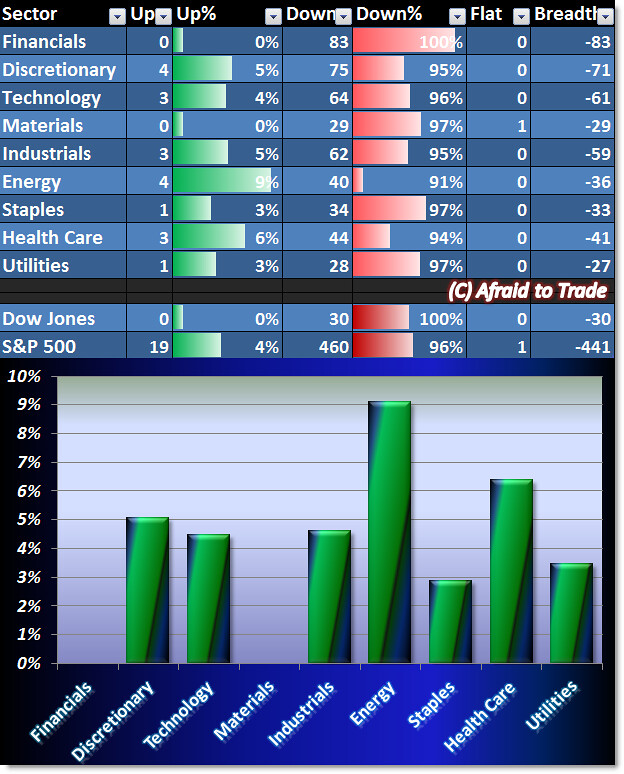

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

All sectors are under their 10% Breadth level, underscoring the power of today’s Trend Day lower.

There’s no strength and we should be avoiding stocks or shorting them, as we’ll see below.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

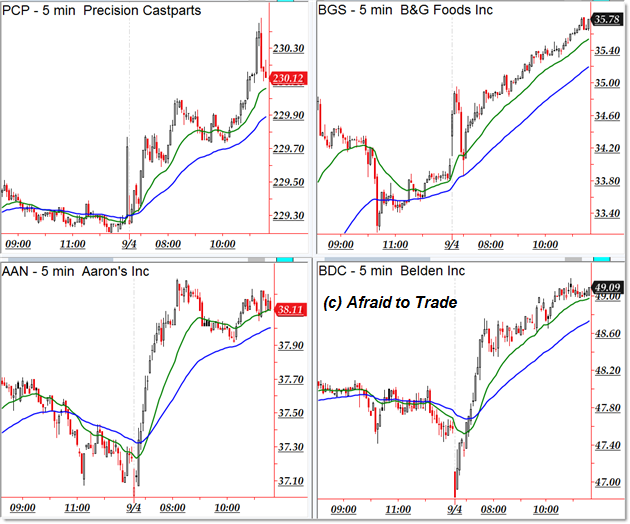

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Precision Castparts (PCP), B&G Foods (BGS), Aaron’s (AAN), and Belden (BDC)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Coca-Cola Enterprises (CCE), SAP, HSBC Holdings, and Honda Motor (HMC)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

We need to be very careful about the trends, as they don’t take much time to switch up, so if we want to be trouble free then we must avoid running against it. I usually prefer to go for long term trading where I can always stay up in safe zone even if I get against the trend and another massive benefit for me is having superb broker like OctaFX, it has swap free facility available, so with that I can work smoothly without much of problem.