Brexit Aftermath Market Update and Big Stock Scan June 24

Well that was surprising.

I’ll leave the explanations for you to read elsewhere as we focus on our standard mid-day market update.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

The U.K. exited the E.U. and so did a lot of money from people’s investment accounts.

So far the S&P 500 collapsed from above 2,110 to the current 2,040 level.

Take a moment to view this morning’s quick update on other markets and their bull/bear reactions.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

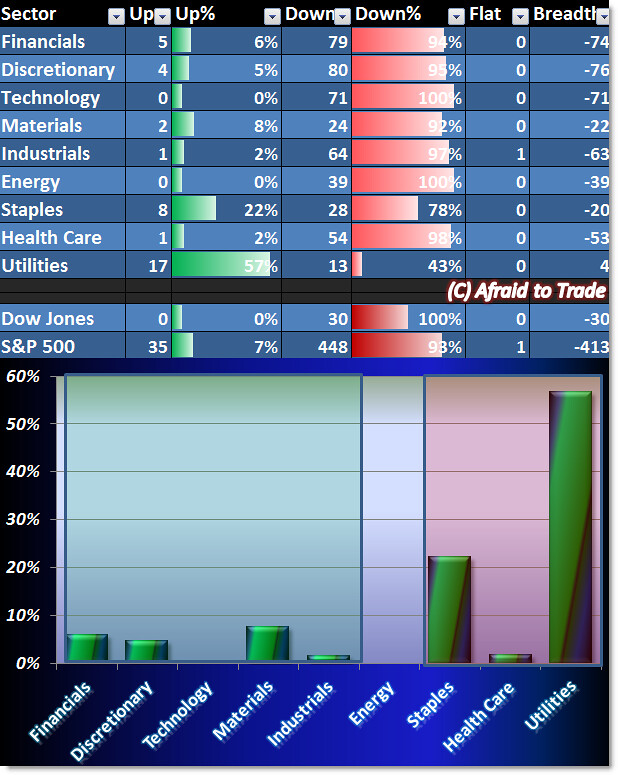

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Not all sectors are bearish; surprisingly, Utilities (a “Risk-Off” group) are positive at the moment.

Unfortunately nothing else is and some sectors are reporting ZERO stocks positive right now.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

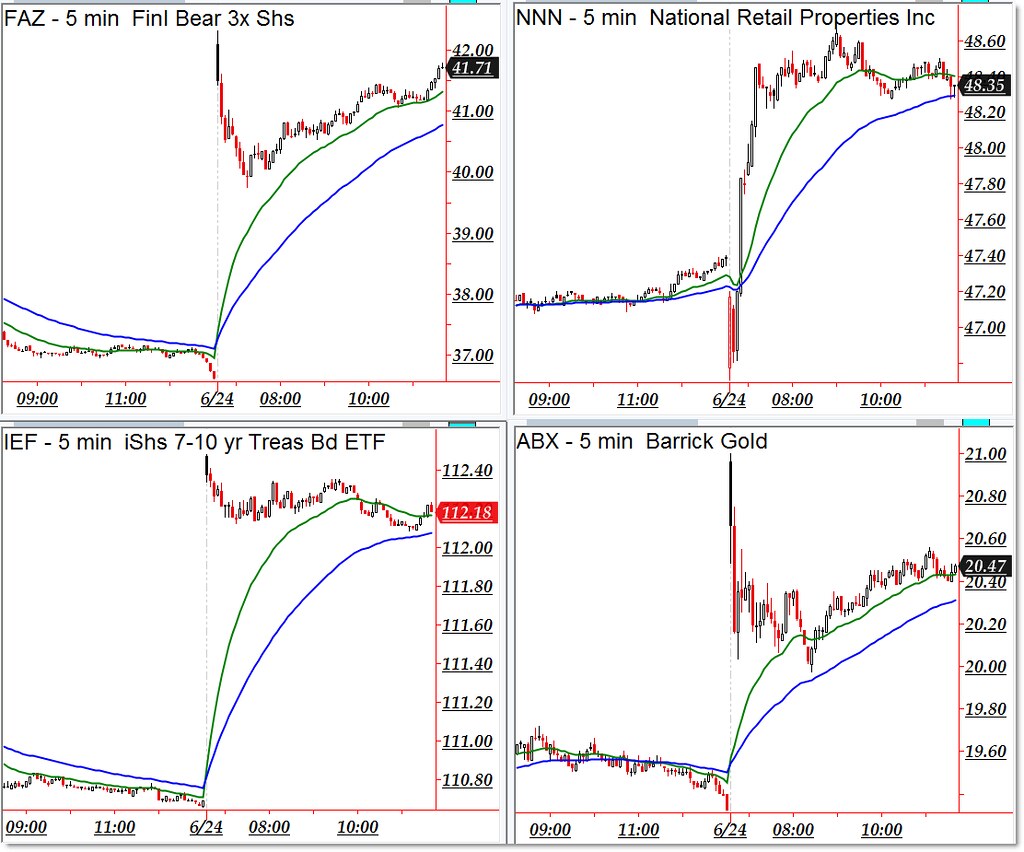

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

I’m breaking my normal rule of not including ETFs from our stock scan based on our algorithms.

3x Leveraged Bear Shares (FAZ), National Retail (NNN), iShares 7-10 Year Treasuries (IEF), and Barrick Gold (ABX)

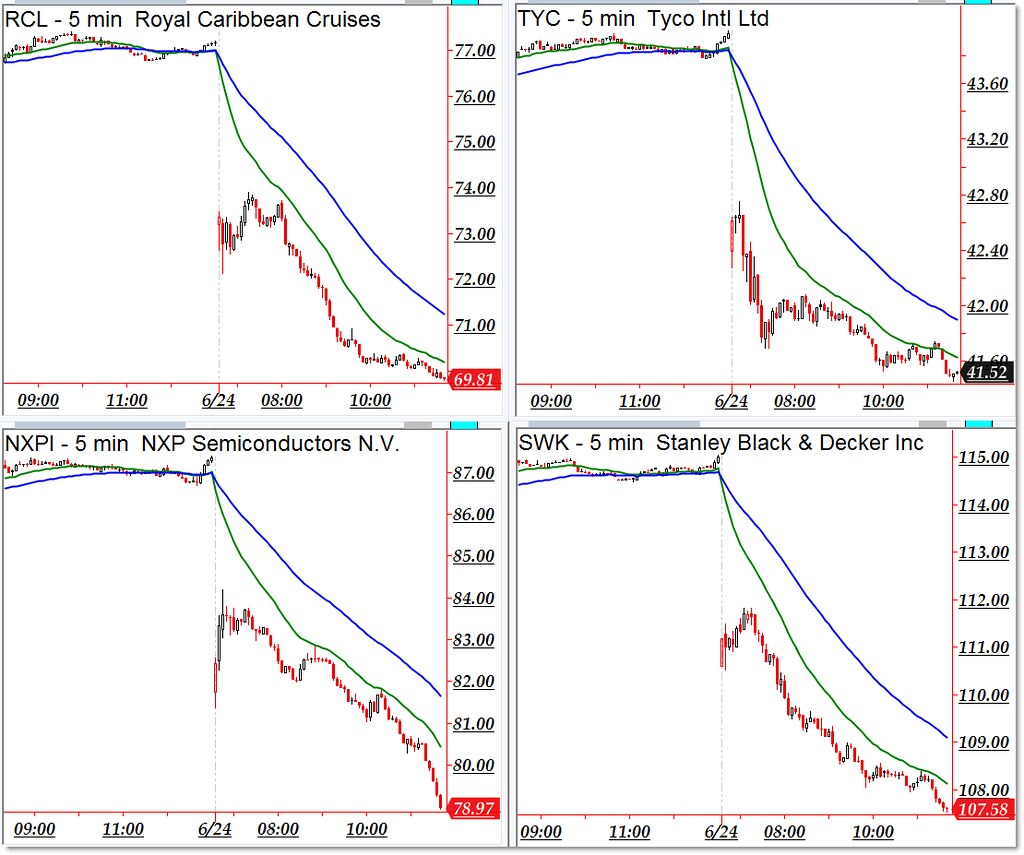

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Royal Caribbean (RCL), Tyco (TYC), NXP Semi (NXPI), Black and Decker (SWK)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Brexit aftershocks are still running in and it will be interesting to see where things go. I go with OctaFX broker since they have amazing daily market news and analysis service update, it keeps me updated with situation and helps a lot with trading while there are no issues over charges since it’s completely free. I also get plenty of help with their swap free account, so I can even go with long term trades; it all makes me comfortable and relaxed with things.