Rounded Arc Forming on NASDAQ Index

Those who know me know that one of my favorite price patterns is the “Rounded Reversal” or “Rounded Arc” pattern, one of which is forming clearly now on the NASDAQ Index. Let’s take a look.

NASDAQ Daily:

If you look slightly backwards to the beginning of January 2010, you see a shorter-term “Rounded Reversal” or “Arc” formation (I didn’t draw it) on the NASDAQ that preceded the sharp sell-off into the February low.

We’re seeing a much larger pattern form now as labeled, and seen best on the 60-min chart.

But before stepping to the lower timeframe, realize that price is in a strong and solid uptrend (as any recent short-seller can tell you) but the momentum may be coming to the apex (highest point).

We’re already seeing the 3/10 Momentum Oscillator form lengthy divergences with price, and the price itself is forming the ‘arc’ (or slow-down) pattern. Volume is also (slightly) trailing off… none of which has stopped the bearish charge yet.

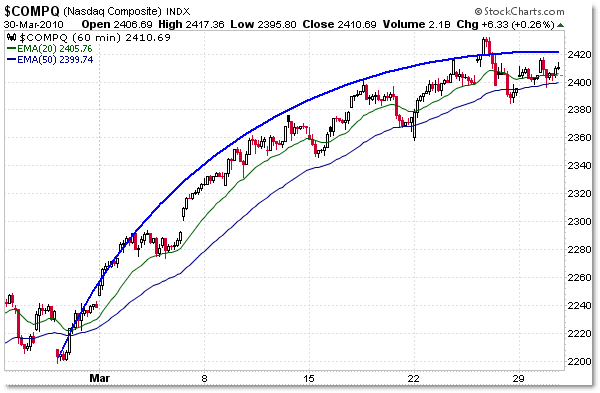

Now let’s drop to the 60-min chart to see this pattern clearer:

There’s two ways you can visualize the ‘arc’ pattern.

First, you can look at the blue arc I’ve drawn with the drawing tool (which I prefer) or second, you can look at the natural ‘arc’ in both the 20 and especially 50 period EMA (moving averages).

Moving averages ‘smooth out’ price swings and reveal the ‘trend’ or price pattern without all the jagged edges (price spikes and bumps).

You can see that both reveal a slowing down or narrowing of price after the end-of-February low (not the full arc as shown on the daily chart).

What’s the implication?

Longs might consider taking profits in the event that price does complete a full rounded reversal and starts to head lower to complete the pattern. This would be triggered with a steady move under 2,380 (which might take a few more days to complete).

Shorts would probably want to wait for a break to occur, rather than step in front of this bullish locomotive… though aggressive and risk-seeking traders would want to do just that.

Keep in mind that this seemingly non-stop rally has continually mocked those who tried short-sell the top, so it would be an aggressive move to short now.

The pattern would be broken/failed with a continued price rise and steepening of the angle such that a right-side arc does not actually form… so be on the look-out for that.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

“Those who know me know that one of my favorite price patterns is the “Rounded Reversal”” – LOL

I honestly didn't know you posted that until after I made this video

http://implicittrading.blogspot.com/2010/03/rev…

How do you distinguish a rounded reversal from “scallops” which are supposed to be a bullish pattern?

They are similar, but scallops can occur at tops or bottoms.

They're indicative of a smooth transfer from buyers to sellers (demand to supply) or vice versa, instead of a climax/sudden move.

The market should move down in a gentle move down as it did while going up… keeping in mind that prices can fall harder than they rise (again, just look back to early January).

This pattern frequently shows up on intraday charts too.

It's such a smooth, simple pattern that is relatively easy to trade.

Would this also explain the Arc'ing action we are seeing now?

Just want to point out some Fibonacci levels to the tracking ETF QQQQ which has a different retracement low (no dividend adjusted, yahoo price history) than the corresponding index:

Inputs for a Downtrend

High 55.07 <– 10-31-2007

Low 25.05 <– 11-21-2008

Fibonacci Potential Rebound Levels

76.40% 32.13

61.80% 36.52

50% 40.06

38.20% 43.6

23.60% 47.99 <– March 2010 high is 48.6 and we are 48.39 EOD now.

I noticed that you like to use MACD(3,10,16) instead of (12,26,9), mind to share your insight on this? Thanks!

This would be an ideal time to go short as tonight the Greatest Entitlement Of All Times will come to an end … The Federal Reserve program of swapping out 1.25 Trillion Treasuries for all kinds of toxic debt held at banks is over.

The Fed has monetized the stock and bond markets to, and even beyond their pre crash levels.

The RevenueShares Financials, RWW, represents Ben Bernanke's portfolio, it contains the financial institutions deemed to big to let fail, it has increased 79% over the last year; other gainers include:

KOL +138% Coal

SLX +112% Steel

XME +88% Metal Manufacturing And Processing

RKH +85%% Regional Banks

QTEC +77% Nasdaq 100

XRT +76% Retail (Sears-KMart has gone up 170%; it has a PE of 51)

CSD +65% Spin Offs

RZV +62% Small Cap Value

RWX +58% Real Estate

RWR +58% Real Estate Reits

Debt investments bubbled up by the Federal Reserve Economic Stimulation include:

CXE, High Income Municipal Debt +40%

FAGIX, Distressed Securities +60%

PHK, PIMCO High Income Debt, +125%

CMU, MFS High Yield State Debt +40%

The chart of distressed securities FAGIX, RWW, KME compared to TLT, … http://tinyurl.com/yjd6ed5

… for the last 12 months, shows how the swapping out of US Treasuries for motgage debt held at banks, investment brokerages, insurance companies and others under TARP and other facilities has monetized debt, as well as stocks, and has depressed the value of US government bonds. The result has been a bloodless coup which has privatized wealth to Wall Street and investors who were savy enough to go long the markets and has socialized losses and toxic debt to the tax paying public.

Tonight, we stand on the very brink of economic disaster as all the Fed inflated investgments start to unwind — the greatest stock and bond bonfire is about to begin. I recommend that one's investments be kept far, far away from the stock market — in gold coins, at BullionVault and in the gold ETF, GLD, in a trust account account, not a brokerage account.

Can you follow up on this Rounded Reversal post? or any 2nd thoughts on this? Thanks a lot.

Can you follow up on this Rounded Reversal post? or any 2nd thoughts on this? Thanks a lot.