Wednesdays with Wyckoff: When to Close a Position

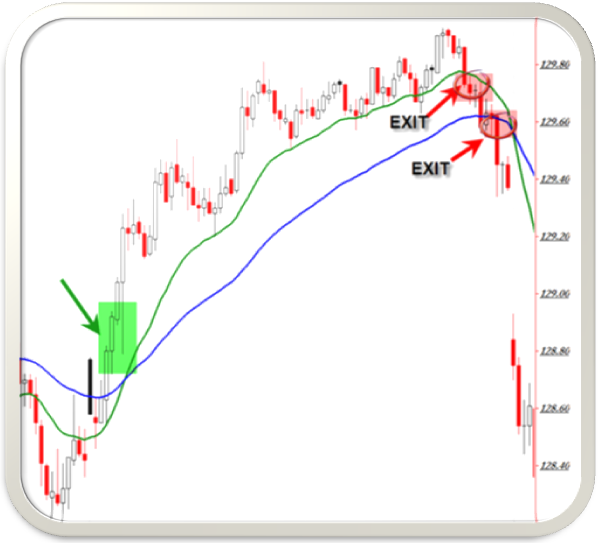

With all the literature out there, it’s easy to find trade set-ups and entry strategies, but the real money is often made with proper exit logic/strategies.

What did classical thinker Richard Wyckoff say about closing a trading position?

In his book Studies in Tape Reading, Wyckoff identifies four specific reasons to close a trade:

“A Tape Reader must close a trade…

- When the tape tells him to close

- When his stop-loss is caught

- When his position is not clear

- When he has a large or satisfactory profit.”

There’s a reason Wyckoff lists “when the tape/price tells him so” as the first point:

“The first and most important reason for closing a trade is that the Tape/Price says so.”

“Within the ribbon of sales recorded in the tape, there runs a fine silken thread of the trend. It is clearly distinguishable to one sufficiently versed in the art of Tape Reading.”

“When one is short [a stock] and this thread suddenly indicates that the market has turned upward, it is folly to remain short.”

“One must have the flexibility of whale bone and entertain no rigid [bullish or bearish] opinion. He must obey the tape implicitly.”

In other words, watch price action (strength, weakness, divergences, impulses) and be on guard for any sudden/unexpected developments while you’re in the trade that directly contradict the reason you entered a trade.

The same goes for #3 when “the position becomes unclear” or price did not behave as expected once you put on the trade. Perhaps you expected a sudden upward impulse but instead, price stagnated – Wyckoff would suggest an exit.

Exiting on a stop-loss is often a necessary precaution to prevent a small loss from becoming a large loss if we continue fighting the price action as it moves against us.

The final point is slightly more controversial in today’s market, as logic would state to continue holding a position that is producing nice profits – but that’s another story we must all address in our own trading plans.

For Wyckoff, the trade entry started with the tape (price) and ended with the tape (price). That’s helpful wisdom from yesterday’s markets to today’s volatile markets.

To read prior lessons from Richard Wyckoff (translated into today’s markets), visit:

“A Stock’s Movement in the Broader Market”

“Life Cycle Stages of a Stock Move”

“How I Select a Stock for Investing”

“Trading a Stock Breaking Through Resistance”

“Trading in Dull Markets and Breakouts”

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available!

buying and selling always looks so much easier than it really is. Technicals tell you one thing. Instincts tell you another. Physical does a whole other thing