Strong Getting Stronger Stock Scan to End November

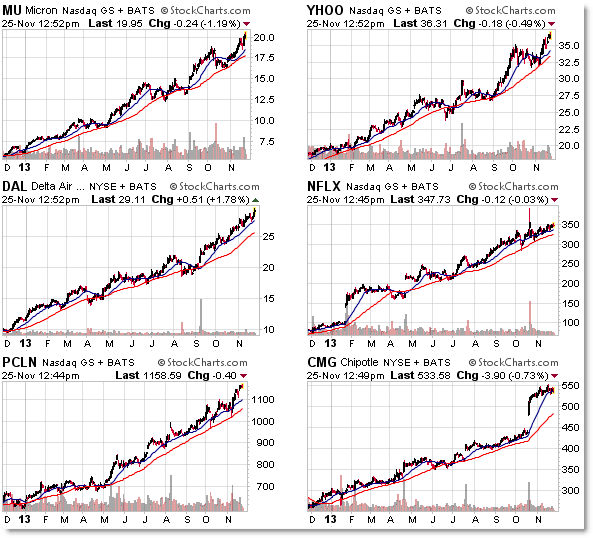

As a follow-up to this morning’s “Consecutive Closes Stock Scan” update, let’s also take a look at current “strong trend and getting stronger” screen for the top trending S&P 500 Charts.

Viewpoint #1: StockCharts.com

Viewpoint #2: FinViz.com

Similarly, we screen for “strong getting stronger” stocks to find hidden candidates that may not appear on more complex stock screens.

These screens tend to reveal strong stocks that tend to have greater odds of getting even stronger in the future as opposed to reversing trend.

The goal is to find candidates for additional study (deeper charting using your own methods/strategies/indicators) as opposed to finding a stock on a screen and then putting on a position.

It’s designed to filter your candidates to a manageable list from which to select the top prospects for swing, position, or even aggressive intraday trading depending on your risk tolerance and preferred trading strategy.

These candidates filter potential breakout and pro-trend retracement (like bull flags) trading strategies to join into an ongoing uptrend.

For additional reference material, see the recent “strong getting stronger” stock updates:

Strong Stocks Getting Stronger

Chipotle (CMG) Extends Gains in Strong Uptrend

Chipotle CMG Breakout, Earnings, and Persistent Rallies

Scanning for Strong Stocks with the Most Consecutive Daily and Weekly Closes

Mid-September Scanning for Stocks Most Overextended to Trade (similar scan)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning parameters as we watch a “hold and bounce” or “break and retrace” scenario play out in the near future.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

The combination of increased supply for many commodities, as well as continued structurally weaker emerging market growth is likely to cause many prices to continue to stagnate through 2014.